Myths and Facts About Small-Dollar Loans

You deserve to hear the truth, no matter how terrifying it may seem. But guess what? Sometimes things seem scary on the outside, but when you get to know more, they’re not so bad.

This is true especially for our products, our business, and our entire industry. So let’s talk about a few common fears about doing business with Check Into Cash.

We’ve investigated some common negative perceptions about our business that we’d like to put to rest. Here are a few myths and facts about small-dollar loans.

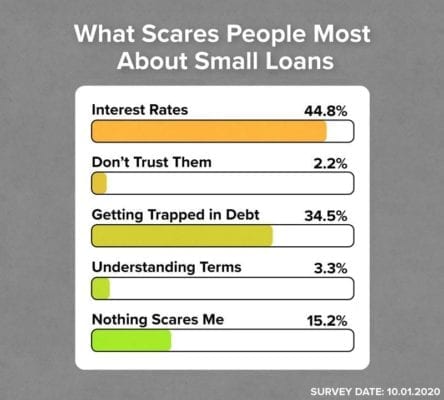

Check Into Cash conducted a recent survey to ask people what scared them most about small-dollar loans. Survey results are calculated from responses of 6,451 participants voting via email.

1. Why Are Interest Rates So High For Small-Dollar Loans?

Well, well, well— this is the one we hear the most often. We’ve been called Price-Gougers, Loan Sharks, and Thieves. You name it, someone has probably said it. It’s understandable, because seeing an interest rate in the triple digits may look outlandish at first. However, the reason why just may surprise you.

Understanding Annual Percentage Rates (APRs)

Most people don’t know it, but regulators require payday lenders to display their interest rates as Annual Percentage Rates (APR). This is measured over a 12-month span. But wait, a typical Payday Advance usually only lasts two weeks. Despite this, we’re required to display rates as yearly percentages.

An Easy APR Example

For a simple example, imagine going to a hotel and asking the front desk clerk “How much is a room for the night?” Then, the clerk responds, “Our rate is $54,750 per year”. Say what!?

While that hotel room is only $150 per night, explaining the amount in yearly terms makes it look and sound much larger. In fact, the average fee for a single payment small-dollar loan is about $15 per $100 of the loan, according to the CFSA. Rest assured, Check Into Cash always lets you know exactly how much you’re going to pay based on your specific loan.

Lower Amounts + Higher Risk

Plus, short-term and small-dollar loans offer lower amounts, but with much higher risk. So, in order for us to support customers and continue offering these loan products, it’s necessary that we charge higher rates than you would traditionally see for larger, lower-risk bank loans.

2. I’ll Get Trapped in Debt Forever with Small-Dollar Loans

It’s obvious, no one wants to be in the position where they need to use our services. However, life happens. And when it does, we are here for you.

We Promote Financial Responsibility

Let’s be real— creditors and bill collectors can sometimes be like blood-sucking vampires, relentlessly holding out their hands while you’re sporting empty pockets. However, Check Into Cash offers relief to help you get back on your feet and silence the noise. We don’t want anyone getting stuck in a cycle of debt. Plus, we strive to promote a healthy financial lifestyle for all our customers and employees, too.

More Loan Products For You

This is the main reason why we started introducing more types of loan products to fit the financial needs of each individual. For instance, a Payday Loan offers low amounts and very short terms; it’s a quick and simple solution. However, the addition of Installment Loans lets you borrow higher amounts and pay back over months instead of weeks, all while rocking a lower monthly payment.

So, whether you need a quick easy boost, or you want to consolidate other debt into one monthly payment, we have your back. Let us help get you out of the dreary tomb of debt.

3. I Don’t Trust Short-Term Lenders

Trust isn’t granted, it is earned. We are aware of the extreme negative perceptions floating around against businesses like Check Into Cash. In fact, we’ve been fighting the angry mob with our good deeds ever since they first chased us with torches and pitchforks.

The Good Suffer for the Bad

With many businesses out there trying to abuse or take advantage of customers in need, this is a very classic case of the few ruining it for the many. To combat unethical procedures of these greedy monsters, Check Into Cash has taken business ethics to the next level. That’s why we joined together with other small-dollar lenders to create a new standard to protect customers like you.

The Community Financial Services Association of America

You may not have heard of it, but Check Into Cash is proudly one of the founding members of the Community Financial Services Association of America (CFSA). Launched in the year 2000, we’ve been a leading member ever since. The CFSA requires higher standards and best practices for small-dollar lenders, all while keeping the financial safety of the customer at the forefront. We believe in full disclosure of our loan products and truthful advertising.

Hopefully this helps to clear up a few myths and facts about small-dollar loans. So, when you’re in a financial bind, know that Check Into Cash is a trustworthy lender with your best interests in mind.

Not all consumers may qualify for loan products noted above; certain restrictions apply. All products and services not available in all states or stores. Rules, fees and limits apply. See store for details.

California: In California, deferred deposit loans are provided in accordance with the Department of Financial Innovation pursuant to California Deferred Deposit Transaction Law, Cal. Fin. Code §23000 et seq.

[custom-facebook-feed]

The information provided on this website does not, and is not intended to, constitute legal or financial advice. Rather, all information, content, and materials available on this site are only meant for general informational purposes. Information on this website may not include the most up-to-date legal, financial or other information. This website contains links to other third-party websites. Such links are only for the convenience of the reader, user or browser. We do not recommend or endorse the contents of the third-party sites nor are the owners of such third-party sites recommending or endorsing our services. Check Into Cash is not affiliated with nor endorsed by any of the websites, companies or entities mentioned in this blog. See a licensed attorney for legal advice and see a certified public accountant or financial planner for financial advice. No reader, user, or browser of this site should act or refrain from acting on the basis of information on this site without first seeking professional advice. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed. The content on this posting is provided “as is,” and no representations are made that the content is error-free.